Employee Retention Tax Credit

February 23, 2023What are some easy deductions for independent truck drivers/owners?

February 23, 2023What tax deductions are available for independent food delivery employees who work for Door Dash or Uber Eats?

As an independent food delivery employee who works for Door Dash or Uber Eats, you may be eligible for various tax deductions. Here are some common tax deductions that may be available to you:

- Vehicle expenses: You can deduct the expenses associated with using your vehicle for business purposes, such as fuel costs, maintenance, repairs, and depreciation. You can use either the standard mileage rate or actual expenses to calculate your deduction.

- Supplies: You can deduct the cost of supplies used for your business, such as insulated food delivery bags, cell phone expenses, and other equipment necessary for your job.

- Home office expenses: If you use a dedicated space in your home for your business, you may be able to deduct a portion of your rent, utilities, and other related expenses as a home office deduction.

- Self-employment taxes: As an independent contractor, you are responsible for paying self-employment taxes, which include Social Security and Medicare taxes. You can deduct half of these taxes on your tax return.

- Insurance premiums: You may be able to deduct the cost of health insurance premiums if you are self-employed and not eligible for coverage through an employer.

It’s important to keep detailed records of your expenses throughout the year to accurately calculate your deductions. Consider working with a tax professional or using tax software to ensure you are taking advantage of all the deductions you are eligible for.

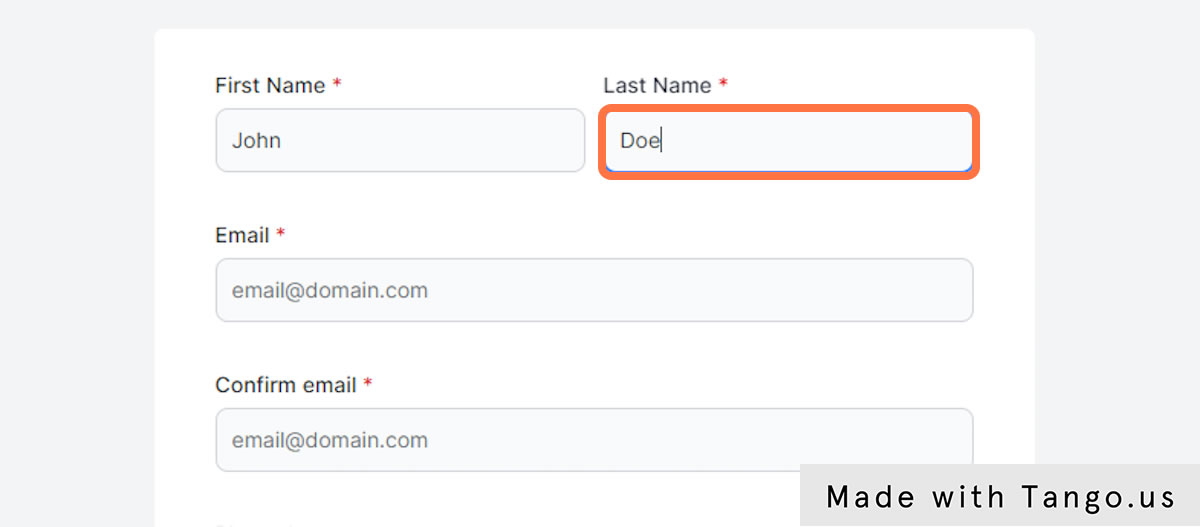

- Come to Tax Titans, create an ANONYMOUS free profile and receive qualified bids on your tax return preparation from vetted, tax pros using the same information and review their credentials from their LinkedIn, Facebook and websites.