November 22, 2024

FOR IMMEDIATE RELEASE Tax Titans Partners with Gleim to Support Military Career Advancement Greenville, SC, November 22, 2024 – Tax Titans is proud to announce a […]

August 22, 2023

WILMINGTON, NC, USA, August 22, 2023/ EINPresswire.com / — Tax Titans, the first online marketplace connecting taxpayers and tax professionals, is thrilled to welcome Thomas (Tom) Godfrey, JD, LLM, […]

April 7, 2023

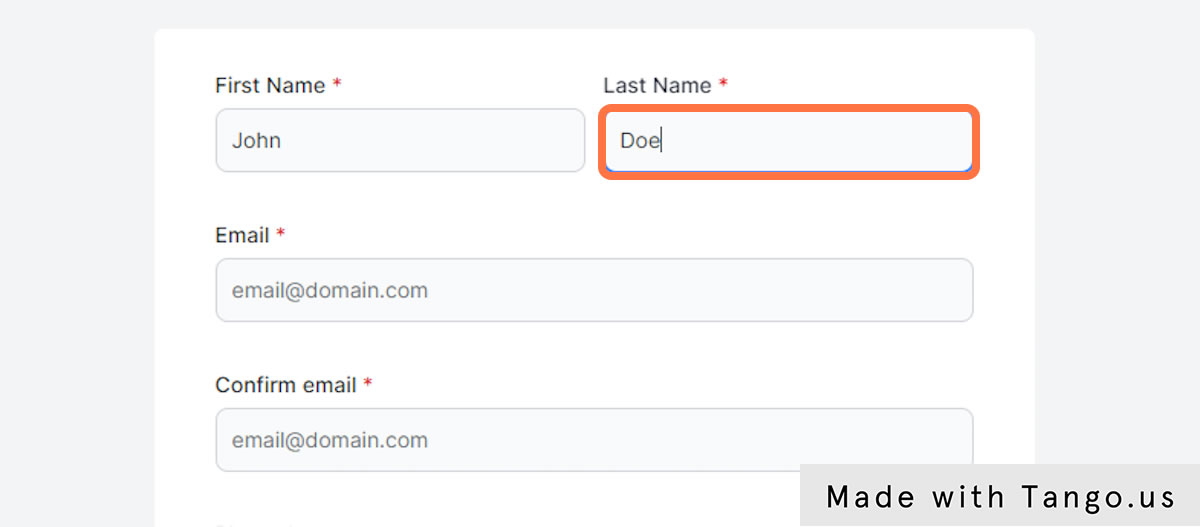

1. Go to app.tax-titans.com 2. Type your first name 3. Type your last name 4. Type your email 5. Type your email again Email Confirmation 6. […]

February 23, 2023

What objections are there to using an online tax preparer AND what are good responses to those objections? Objections to using an online tax preparer may […]

February 23, 2023

What is an EFIN in relation to tax preparation and why does it enhance trust of an online tax preparer? EFIN stands for Electronic Filing Identification […]

February 23, 2023

What does it require to become an Enrolled Agent, and how is this designation similar AND different from the label of CPA? To become an Enrolled […]

February 23, 2023

Is online tax preparation a growing way to get your small business tax return completed? Yes, online tax preparation is a growing way to get your […]

February 23, 2023

Can you save money on your tax return preparation costs by shopping online for a tax professional? Yes, it is possible to save money on tax […]

February 23, 2023

Does it cost money to file a tax extension for my small business? Filing a tax extension for your small business may or may not cost […]