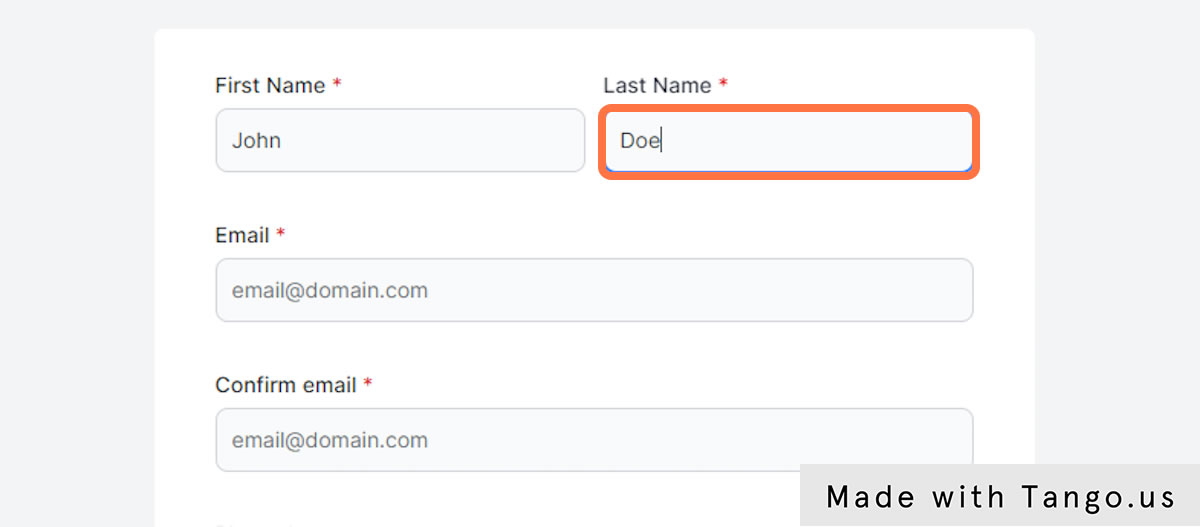

WILMINGTON, NC, USA, August 22, 2023/ EINPresswire.com / -- Tax Titans, the first online marketplace connecting taxpayers and tax professionals, is thrilled to welcome Thomas (Tom) Godfrey, JD, LLM, CPA as President and Chief Strategy Officer. With a career spanning several decades, including over 14 years at Deloitte Tax LLP, Tom brings a wealth of tax and leadership […]